What you'll expense when you're expecting, again

2021 was the year my husband and I were lucky to welcome our second child, a daughter, into the world. As second-time parents, we were curious as to what it would look like, and what we would look like, as battle-hardened veterans.

We knew there would be some economies of scale in having a second child, and we hoped the monumental learning curve we’d had with our first child, a son, would serve us well both practically, and financially.

As I documented in What you’ll expense when you’re expecting, leading up to the birth of our son we spent $17,500. Using the data I collected on expenses from that pregnancy and post-partum, I’d anticipated we’d need about $12,500 this time.

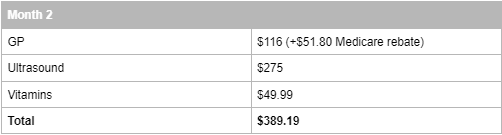

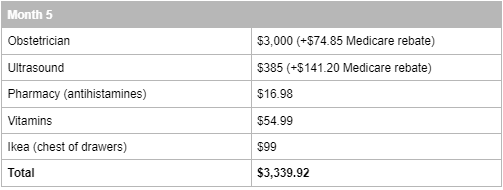

We spent around $13,000. I was pretty close! Here’s how our journey unfolded.

Safety nets and bloody pandemics

As a financial adviser and advocate for strong financial health, I’ve long campaigned on the importance of a buffer (a cash safety net). Buffers play critical roles in life in general, let alone when you’re starting, growing or living with a family.

My husband and I had saved up the $12,500 we’d anticipated to fund baby number 2. However, because we had just a short gap between our babies, we didn’t have time to save all the funds that would be required to fully cover my time out of the workforce.

Therefore, we made the decision that we would use a portion of our buffer. We were comfortable to lessen our cash security blanket in return for not having to wait another year or so to have our second.

However, one challenge came that we weren’t anticipating. Like many, Covid-19 hit directly in the hip pocket. For us, it wasn’t our employment that suffered, but our income from property.

Like ours, many families are cashflow negative whilst one or both parents take time out of the workforce to care for young children. And like ours, many families utilise their assets, cash or investments to help fund that shortfall, so things got tighter with Covid-19.

Whilst I knew we had layers of protection in place, it would be misleading for me to say that the pregnancy and my maternity leave were without heightened financial awareness. Therefore I can’t emphasise more vehemently the importance of well thought through financial back-up plans.

The big expenses

Leading up to the birth of our daughter, we didn’t replicate everything we’d done in the past. Our reality in 2021 was different to 2019, and therefore we spent our money differently too.

To begin, we were able to avoid some big capital expenses for a second child, and utilise what we already owned. Items like the baby capsule and fabulous pram that we invested in for our son really paid for themselves, as we could reuse them and adapt the pram to be fit-for-two with an adjustment piece. It now has both the seat (for our toddler) and bassinet (for our baby) on easy rotation, plus a skateboard for the days they both need to travel together.

However, due to the age difference of our children (18 months), we decided that certain items needed to be purchased again, like another cot, rather than turf our son out prematurely.

Healthy is handy

As I explained in my first story, prior to having my son I had a miscarriage, which not only costs emotionally but also financially.

A miscarriage doesn’t just bring the direct costs associated with that pregnancy, but in subsequent pregnancies it brings indirect costs such as additional scans, complementary health professionals and counselling. It looks different for everyone, but it’s a crappy reality that you will likely spend more if you have experienced loss or complications in the past.

This time around, having brought one beautiful child into the world, my anxiety was reduced and so were the costs.

To support my wellbeing through the pregnancy, I invested in Clinical Pilates classes with a physiotherapist. The cost was not dissimilar to the one-on-one Pilates with a personal trainer I did with my past pregnancy, and I’m glad I shifted to what my body needed at the time.

Last time, I’d spent a small fortune on dermatology to manage a hormone induced skin crisis. This time, I was able to avoid that. However, I needed to invest in some women’s health physiotherapy to assist with pelvic floor challenges.

Convenience (again)

After the big expenses and healthcare, there were a number of things we spent money on that I know we could have lived without. But we decided to invest in minimising disruptions for our son whilst maximising convenience for ourselves as parents. This means we are the proud owners of two bassinets, three change tables and two rocking chairs, to make life easy in our two-storey house.

Convenience for me sometimes meant spending on hospital car parks rather than parking three streets away because it made me less anxious about running late. At other times it was using two Dinner Ladies (a home delivery service) meals a week instead of one because we ran out of time or energy to cook. A lot of these convenience costs we tried to absorb into our personal spending, but some of them are reflected in the data below.

Carried away on clothes

I often find restraint easy, moderation to be difficult. Being modest and considered in my spending when preparing for the first child came easy. The next time I got a bit carried away.

I’m not sure if it was a by-product of being conservative the first time, or that I was having a daughter, or perhaps it was the thought that this was my last time in this position. Or it could be the heavy blanket that living in Covid-19 lockdowns added.

Whatever the reason, I found myself buying new clothes for our little one when I knew I could have easily borrowed from others, or quite simply lived without.

Different baby, different rules

Despite telling myself a million times throughout the pregnancy that this was a different child, I was understandably anchored in my past experiences. This largely affected my expectations coming into labour (and the two experiences couldn’t have been further apart) but it also impacted the way I prepared for a newborn.

My first experience with a newborn was of multiple outfit changes a day. If we made it 24-hours in the same onesie, we celebrated. But with a little baby boy who would pee everywhere once the nappy was off and happily chuck after most feeds, outfits were on high rotation (as was the washing machine). And let’s not talk about explosive poo. So, preparing for the next, I made sure I had 10+ onesies and singlets etc. in sizes 0000 and 000 respectively.

Enter an entirely different baby.

This baby was a girl, and without an unruly penis. She also rarely threw up. I often found myself changing her clothes every two days because I felt that I needed to use the stock in the wardrobe, rather than because anything was actually dirty.

For the first month or so, I felt like a goose, like I’d completely overspent. But I know my preparation was solid, based on real lived-in facts. The fact that I had a bizarrely contained baby could not have been anticipated.

The cost of waiting

The limbo that comes from being post-work but pre-baby is a strange place to be. Early on, it’s fabulous. You can busy yourself with nesting, planning, resting (or trying to get comfortable). But once your to-do list is done, waiting for a baby can range from uncomfortable to down-right misery.

This time around, I had the lovely distraction of my toddler, so there were less days sitting around and hoping to go into labour. You know the saying ‘idle hands are the devil’s workshop’? Well, a heavily pregnant woman killing time at a shopping centre may in fact be the modern financial equivalent.

Whilst I had enough vestiges of discipline to avoid mindless shopping, I did find myself at the acupuncturist and the local Chinese medicine practice several times. Anything to bring on labour. I can imagine if my pregnancy went into 40+ weeks I’d need a bigger budget.

Money pays

Knowing money was available to invest in the healthcare I needed through pregnancy and post-partum has been a defining element for me. After two children, I believe firmly in families setting budgets that first and foremost care for women.

I have spent more on health care (outside of the chunky obstetric bills) in the last three years than in the proceeding 10 years. I am intensely grateful to have had the money available to care for myself, my babies and my family in a way that meets both my expectations and all of our needs.

The last time I completed this documenting exercise, I shared five steps to consider when thinking about your own pregnancy and baby preparation. After going through it all again, I can reaffirm each of them.

Firstly, think about your context, so you have some idea of what things might be uniquely important to you. Trying for a VBAC (vaginal birth after caesarean) made the decision to stick with our private obstetric and midwifery team non-negotiable for me. It was a wonderful feeling throughout the pregnancy to never doubt that expense and it’s value to us.

Secondly, think about your priorities. Convenience and minimising disruption for our son were very important this time around.

Thirdly, think about your preferences. For me, finding products that were more environmentally sustainable was important. We opted for biodegradable or reusable wipes which aren’t the cheapest, but we felt happier with that choice. Your choice could be to buy local, or to ensure that everything comes from charity stores, or maybe you want certain brand names. Every decision will impact your costs.

Fourthly, have in mind that not all births go to plan, and it can be useful to have some budget factored in just in case. I’m deeply grateful that I had a beautiful birth experience this time around, but that doesn’t mean that we skip off into the sunset after giving birth. This report is focused on the pregnancy and the immediate postpartum, but in the months after my daughter was born, we invested heavily into physiotherapy to support my recovery and the reality of life lugging around a baby and a toddler.

Finally, avoid the ‘shoulds’, or trying to keep up with what everyone else is doing. This article is a reflection of my own experience, and is far from being a guide of ‘how to do it’. You can treat this breakdown as a way of thinking about your own situation and those reflections will dramatically influence your costs.

There are so many things to think about when having a baby. Some days my head feels like it might explode trying to remember to get things done, cross-referencing which baby did what and when, trying to be present whilst planning a million things for the future. But having your finances organised is something that is both necessary and achievable. Think about your money and get organised, so you can get on with parenting (and making it all up as you go).